REITaxCPA Financial Blog

Standard Mileage Rates for 2021

Starting January 1, 2021, the standard mileage rates for the use of a car, van, pickup, or panel truck are as follows: 56 cents per mile driven for business use, down 1.5 cents from the rate for 202016 cents per mile driven for medical or moving purposes for qualified...

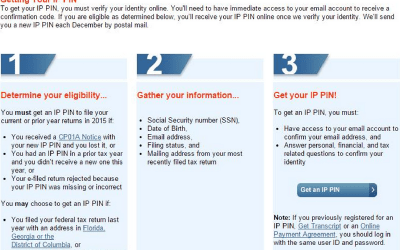

Identity Protection PIN Available To All Taxpayers

Starting in January 2021, the IRS Identity Protection PIN Opt-In Program will be expanded to all taxpayers who can properly verify their identity. Previously, IP PINs were only available to identity theft victims. What is an Identity Protection PIN? An identity...

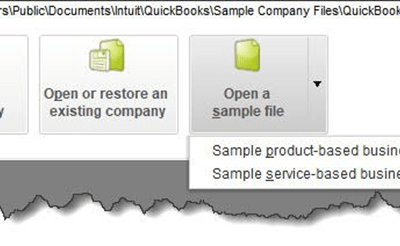

New to QuickBooks? Try These Five Activities

Tackling any new piece of software can be daunting. Add a complex process like accounting to the mix, as QuickBooks does, and you may feel apprehensive about your ability to learn how to use it. But QuickBooks was designed for small business people, not for...

Credit Reports: What You Should Know

Creditors keep their evaluation standards secret, making it difficult to know just how to improve your credit rating. Nonetheless, it is still important to understand the factors that determine creditworthiness. Periodically reviewing your credit report can also help...

Subscribe

Subscribe

Additional REsources

A Few Other Resources We’ve Created for Our Customers

Employee Business Expense Deductions: Who Qualifies?

Prior to tax reform, an employee was able to deduct unreimbursed job expenses, along with certain other miscellaneous expenses, that was more than two percent of adjusted gross income (AGI) as long as they itemized instead of taking the standard deduction. Starting in...

Standard Mileage Rates for 2021

Starting January 1, 2021, the standard mileage rates for the use of a car, van, pickup, or panel truck are as follows: 56 cents per mile driven for business use, down 1.5 cents from the rate for 202016 cents per mile driven for medical or moving purposes for qualified...

Identity Protection PIN Available To All Taxpayers

Starting in January 2021, the IRS Identity Protection PIN Opt-In Program will be expanded to all taxpayers who can properly verify their identity. Previously, IP PINs were only available to identity theft victims. What is an Identity Protection PIN? An identity...