REITaxCPA Financial Blog

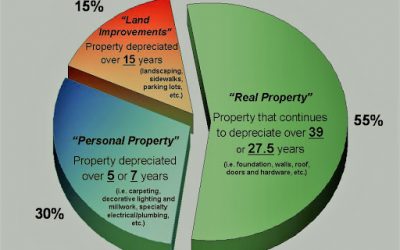

Cost Segregation and Catch-up Depreciation

If you have owned a commercial building for several years, a cost segregation study can still be applied. It is a simple process that can lead to large depreciation deductions in the current tax year. When you apply a cost segregation study to a building you have...

Restrictions On Receiving Cash In A 1031 Exchange

When you are doing an exchange it is important to understand that federal tax regulations limit your rights to receive, pledge, borrow, or otherwise obtain the benefits of the money held by the intermediary during the exchange period. Once your relinquished property...

The COVID-related Tax Relief Act of 2020

The Consolidated Appropriations Act, 2021, H.R. 133 included funding for the government, extensions for expiring tax extenders, tax relief under the COVID-related Tax Relief Act of 2020, and many more items. Passed by both the House and Senate, it was signed into law...

Employee Business Expense Deductions: Who Qualifies?

Prior to tax reform, an employee was able to deduct unreimbursed job expenses, along with certain other miscellaneous expenses, that was more than two percent of adjusted gross income (AGI) as long as they itemized instead of taking the standard deduction. Starting in...

Subscribe

Subscribe

Additional REsources

A Few Other Resources We’ve Created for Our Customers

Cost Segregation and Catch-up Depreciation

If you have owned a commercial building for several years, a cost segregation study can still be applied. It is a simple process that can lead to large depreciation deductions in the current tax year. When you apply a cost segregation study to a building you have...

Restrictions On Receiving Cash In A 1031 Exchange

When you are doing an exchange it is important to understand that federal tax regulations limit your rights to receive, pledge, borrow, or otherwise obtain the benefits of the money held by the intermediary during the exchange period. Once your relinquished property...

The COVID-related Tax Relief Act of 2020

The Consolidated Appropriations Act, 2021, H.R. 133 included funding for the government, extensions for expiring tax extenders, tax relief under the COVID-related Tax Relief Act of 2020, and many more items. Passed by both the House and Senate, it was signed into law...