by REITaxCPA | Jan 11, 2021 | Uncategorized

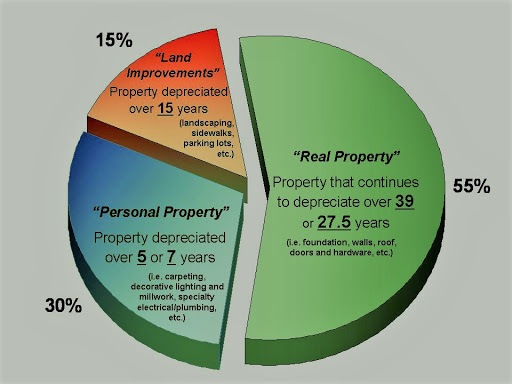

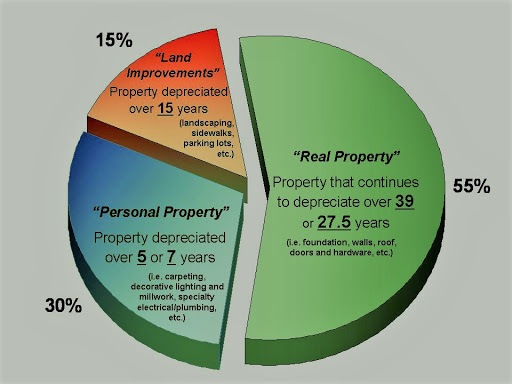

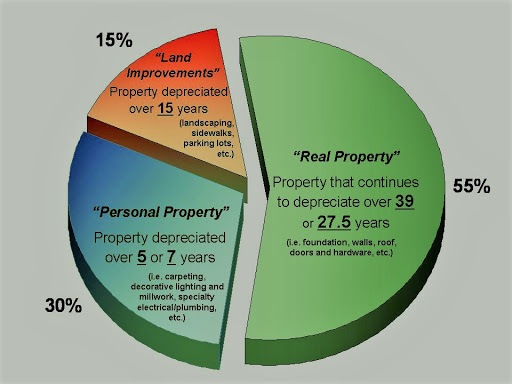

If you have owned a commercial building for several years, a cost segregation study can still be applied. It is a simple process that can lead to large depreciation deductions in the current tax year. When you apply a cost segregation study to a building you have...

by REITaxCPA | Jan 11, 2021 | Uncategorized

When you are doing an exchange it is important to understand that federal tax regulations limit your rights to receive, pledge, borrow, or otherwise obtain the benefits of the money held by the intermediary during the exchange period. Once your relinquished property...

by REITaxCPA | Jan 3, 2021 | Uncategorized

The Consolidated Appropriations Act, 2021, H.R. 133 included funding for the government, extensions for expiring tax extenders, tax relief under the COVID-related Tax Relief Act of 2020, and many more items. Passed by both the House and Senate, it was signed into law...

by REITaxCPA | Dec 5, 2020 | Uncategorized

Prior to tax reform, an employee was able to deduct unreimbursed job expenses, along with certain other miscellaneous expenses, that was more than two percent of adjusted gross income (AGI) as long as they itemized instead of taking the standard deduction. Starting in...

by REITaxCPA | Dec 5, 2020 | Uncategorized

Starting January 1, 2021, the standard mileage rates for the use of a car, van, pickup, or panel truck are as follows: 56 cents per mile driven for business use, down 1.5 cents from the rate for 202016 cents per mile driven for medical or moving purposes for qualified...

by REITaxCPA | Dec 5, 2020 | Uncategorized

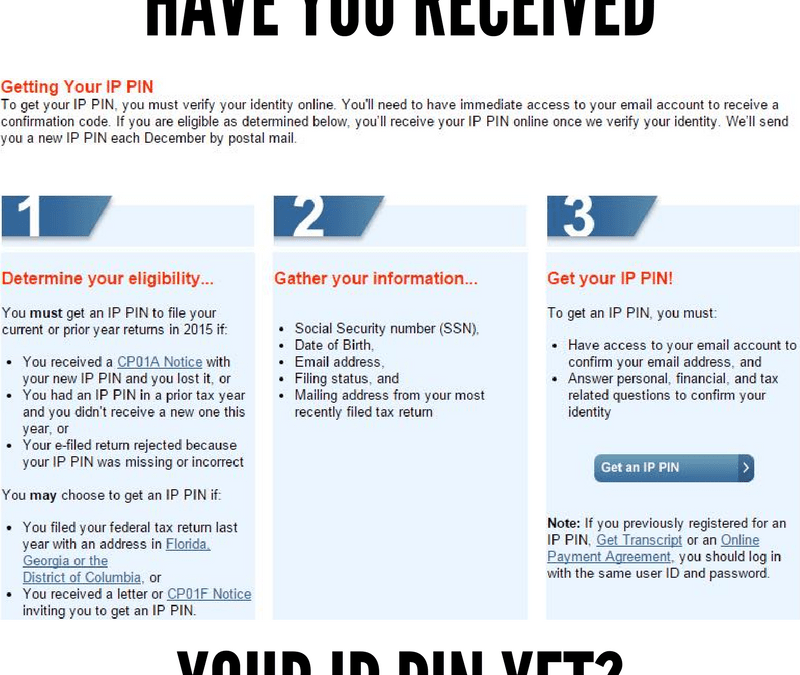

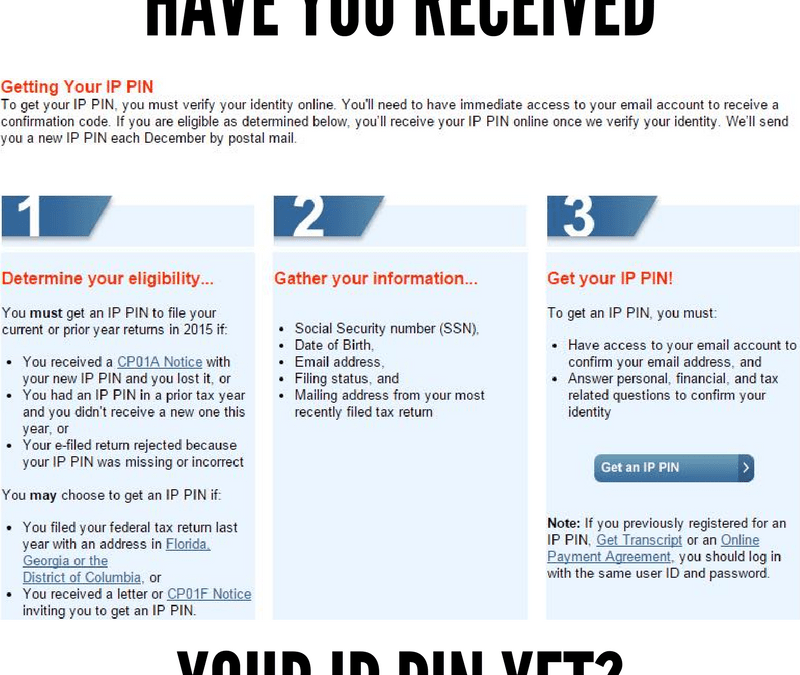

Starting in January 2021, the IRS Identity Protection PIN Opt-In Program will be expanded to all taxpayers who can properly verify their identity. Previously, IP PINs were only available to identity theft victims. What is an Identity Protection PIN? An identity...

Recent Comments